Best Binary Options Strategies

If you’re looking to get started with binary options trading, you’ve come to the right place. Here we provide valuable tips and strategies to help you achieve success in the world of binary options. This is the ideal source for anyone looking to delve into binary option trading strategies. Here, you will find everything you need to know to get started, from basic binary options strategies and approaches to the more advanced strategies. You can locate detailed information on various binary options strategies by reading this article.

Contents

Basic Strategy For Successful binary options trading

Having an effective strategy is critical for successful binary options trading. It can help you maximize returns and minimize risk, allowing you to make the most out of your investments. Establishing a trading framework is essential for effective trading. This includes decisions related to money management, as well as strategies and tactics on how to make profits from the market. Unfortunately, there is no one-size-fits-all solution when it comes to trading. Each situation is unique and requires its own tailored approach. As such, successful traders must be able to identify the best strategy for their specific situation, based on market conditions and individual risk tolerance.

Generally, strategies are divided into two main categories:

- Fundamental

- Technical.

Trading binary options require knowledge of technical aspects rather than the fundamentals such as the health of companies, indices, markets, and economies. Fundamental strategies serve as a good background for trading but are less important in short-term investing and trading.

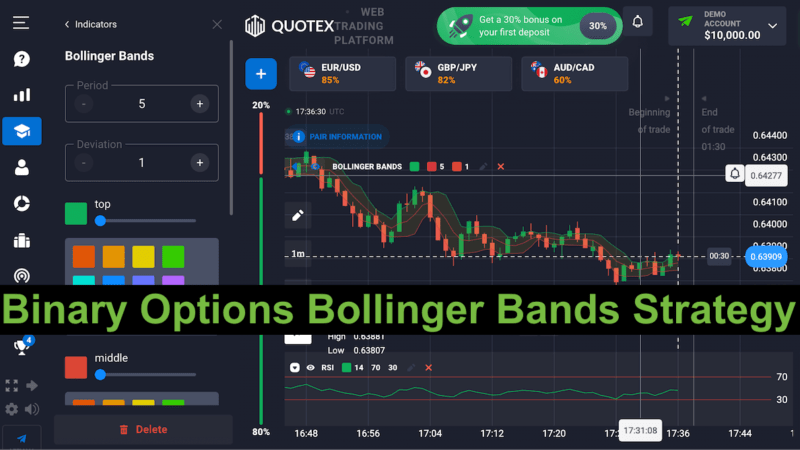

Technical trading or technical analysis is used by traders to identify patterns in stock charts and price movements. By monitoring historical data, correlations and trends can be identified that can then be used to make educated predictions about the future of a given stock. Technical analysis relies heavily on the use of technical indicators such as moving averages, support and resistance levels, momentum oscillators, and more in order to anticipate price changes. Additionally, traders may also utilize various charting techniques such as candlestick charts or trend lines to better forecast potential price movements.

By implementing a strategy, trading has been made easier as it eliminates the need to guess entry points and minimizes overall risks.

A strategy is a blueprint for achieving a specific goal. It involves planning and executing operations to ensure success in the end. Basically, it’s the art of planning to win. When it comes to trading, the main objectives are to maximize profits and minimize losses. Utilizing effective strategies is key in achieving these goals.

To accomplish this goal, the most widely used method relies on a rules-based selection of entries based on technical analysis indicators that have been tested and proven to be effective over time. The market offers an enormous variety of trading opportunities, and with it, a multitude of strategies to choose from. One can easily find dozens, if not hundreds or thousands of ways to trade the markets. Binary option trading strategies can be classified based on the tools they use, the time frames they are expected to work within and the level of risk associated with it. These criteria are among the most important aspects when considering a binary option strategy.

- Trend Following / Directional Strategies – Trend following is a popular trading strategy that focuses on identifying assets that are experiencing serious price movements and using this data to generate profitable entry points with a greater chance of success.

- Price Action / Scalping Strategies – Price action traders focus on the fluctuation of security prices to identify buying and selling opportunities in the market. Strategies are then developed to capitalize on these fluctuations. Investors can adopt numerous strategies when trading in the stock market ranging from long-term to short-term, bullish to bearish, or trend-based to range-bound.

- Long-Term / Momentum Strategies – These strategies focus on stronger indicators and longer-term trends, making them less risky than other approaches. Although signals with a higher probability of success require more time and effort to form and unpack, they are still worth the wait.

- Range Bound / Short-Term Strategies – Generally speaking, markets and assets tend not to show any long-term trends – they usually move up and down in a particular range instead. High and low marks often define those tops and bottoms of the range. Several strategies have been developed to leverage asset price movements in the market. These involve pinpointing levels of support and resistance, recognizing reversals within a range and following short-term trends as assets move between support and resistance points.

Technical Analysis indicators are mathematical formulas that summarize price action into an easily interpretable visual format. This can be used to identify trends and make more informed trading decisions. Technical Analysis indicators can also be used to analyze historical data, helping investors make more accurate predictions about future price movements.

This helps investors and traders to more quickly make better decisions when analyzing the market. Various indicators are used to identify trends in markets and predict future price movements. Common ones include moving averages, trend lines, support and resistance levels, oscillators, and Japanese Candlesticks.

Basics of the Best Binary Options Trading Strategy

Crafting a successful binary options trading strategy requires consideration of several essential elements like signals, risk management, strike prices, and emotional regulation. When searching for the best plan, be sure to understand these factors so you can make informed decisions.

Signals

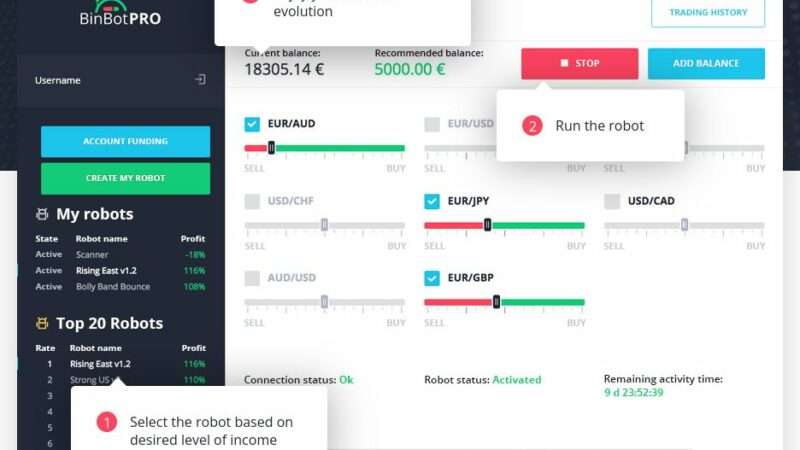

It’s important to create a signal plan that complements your chosen binary options trading strategy as not all of them come with one already. Having a customized signal plan can give you an edge and make your approach much more successful. Binary options signals are a great way to keep up with the trends in the market. They can be sent out by businesses, experienced traders, computer programs, or technical indicators so that you don’t have to waste time manually analyzing data. If you want to enter the world of day trading binary options, it’s important to do your own research first in order to have a better understanding of how the market works. That said, signals can be quite beneficial and should not be overlooked.

Risk Management

Binary options trading carries a high level of risk and thus, effective risk management is essential. This kind of trading has the potential to generate high returns but also involves a significant amount of risk. To manage their risk wisely, veteran traders limit the amount of capital they’re willing to risk per options trade to 1-5% of their total capital. We would go as far as to recommend risking no more than 1% of your capital, especially as a beginner. A strategy that details how to minimize your risk so that you do not make too many mistakes and potentially lose all of your risked capital. In general, a solid strategy will help you calculate your position size on each and every trade as you begin. The longer you have been trading and the more comfortable you are with binary options, you won’t have to constantly calculate your position with the fluctuations of the market. Rather, you can simply pick a specific number and trade with that number each time you trade.

Strikes

A strike price is a price at which a specific contract will execute. It’s very important for a solid binary options trading strategy to outline the choice of clear criteria for strikes. For example: If a trader believes that a specific option will not reach a particular price level target, that trader should sell the binary strikes above their price target with the same types of binary option. A good strategy will outline exactly how a trader should act on strike prices.

Emotional Control

Binary options trading relies on a significant amount of emotional control. This goes for most types of investing, but it is especially important for binary options trading. Because of how volatile binary options trading is, it is way too easy to make a bad choice or inaccurate prediction in order to save the profitability of an option. A good binary options trading strategy should also include a high level of emotional control. A good way to improve one’s approach to emotional control is to start with a demo account when starting the trading process.

Backtesting binary option strategies

Backtesting is an important step in developing a binary options trading strategy. By backtesting strategies on a demo account, traders can test their strategies in real-time and assess whether they have the potential to be profitable. Backtesting also allows traders to identify weaknesses in their strategy and make adjustments accordingly before risking real money. This helps traders become more confident in their ability to successfully execute trades in the future.

Opening a demo account with a reliable binary options trading platform is essential for any individual wanting to become a successful trader. Demo accounts allow traders to practice their strategies without risking any capital. Additionally, these accounts provide access to real-time market data and allow traders to test their strategies against real-world scenarios. With the help of a demo account, traders can develop and refine their trading skills before using real money in the markets.

| Broker | Max Payout | Min. Deposit | Bonus | Rating | Free Demo | Official website |

|---|---|---|---|---|---|---|

|

98% Payout | 10$ Min. Deposit | 70% Bonus | 5/5 Rating | Demo available | Open a demo account |

|

95% Payout | 10$ Min. Deposit | No bonus | 5/5 Rating | Demo available | Open a demo account |

|

90% Payout | 10$ Min. Deposit | No bonus | 4.5/5 Rating | Demo available | Open demo account |

|

92% Payout | 50$ Min. Deposit | 50% Bonus | 4.5/5 Rating | Demo available | Open a demo account |

|

90% Payout | 10$ Min. Deposit | No bonus | 4.5/5 Rating | Demo available | Open demo account |

Top 7 Best Binary Strategies

Even though experienced traders may find success with these strategies, it is possible that they may not always yield hefty profits. It is important to be aware of this before taking any risks. Trading in binary options can be a risky venture, with outcomes that are pretty unpredictable. Even if you have the best knowledge and strategies, it’s still possible to incur large losses. When trading binary options, most traders advise sticking to an investment level of no more than 5% of your total capital. This ensures that any potential losses incurred won’t affect the majority of your funds, while still allowing you to make profitable investments. Professional traders usually only put at stakes a fraction of their capital, usually ranging between 1-2%. This helps to minimize potential losses and maximize potential gains. Although binary options trading can be quite advantageous, it carries a fair amount of risk. As such, it is advisable to keep your investments to a minimum in order to stay safe.

1. Follow Trends

The most profitable way to trade binary options is to follow the market trends in your particular industry or asset. That way, you can maximize your returns and minimize the risk of unexpected losses. The value of various investments often changes due to market trends and other factors. Decreasing or increasing asset prices will cause corresponding changes in their associated investments’ worth. Binary options trading is essentially speculation on the prices of markets in real-time, which is why it’s so challenging and rewarding. Zigzag trading is a popular strategy employed by traders, where they buy and sell stocks based on current trends or short-term fluctuations in the market. With this technique, trends can be seen to follow an irregular path rather than a linear one. When analyzing your chart, pay particular attention to the trend lines. If you notice that one is not changing much, it may be wise to seek out another asset to invest in. A steeply ascending trendline is likely indicative of a possible price increase in the near future.

2. Follow the News

This strategy correlates to our initial plan. Keeping abreast of news items, trends and events concerning your asset can assist in forecasting how it will perform in the trading market. Keeping up with the news is much easier than doing technical analysis, making it a great option for novice traders. To get started, decide which asset you want to trade and then find information about it online, on TV, the radio or in newspapers. Keeping up with tech news can help you anticipate announcements from major companies in the tech space. By tracking their news, press releases, and social media accounts you’ll be better informed and able to make informed decisions. If you anticipate a company will be releasing a new product, you can purchase options and wait for the resulting profits that may come after it is released. This is a good way to potentially benefit from the launch of a new product.

3. The Pinocchio Strategy

This method is quite comparable to the previous one, with the primary difference being that traders bet against the trend. For instance, when an asset’s price is escalating in a rising trend, then a trader will take an option in order to anticipate a possible decrease in its value. With that idea in mind, the trader should choose an option with the expectation of that asset’s price going up if it is experiencing a declining trend.

Choosing the right option when trading is essential for success. When an asset’s price is declining, the trader should consider buying an option with the expectation that their chosen asset’s price will go up.

By looking at a candlestick chart, it is possible to determine whether the market is bullish or bearish. This can be identified by the light or dark candles, which indicate the direction of movement of the market. When trading options, if the wick of the chart is pointing downwards then you must select a call option. Conversely, if it points upwards then you should go for a put option.

4. The Candlestick Formation Patterns Strategy

If you’re adept at interpreting asset charts, why not give this trading strategy a try? Candlestick charts are used by traders to track the price movements of an asset over a period of time. The top of a candle in technical analysis refers to the highest historical price that an asset has reached, and the bottom of the candle represents its lowest price. This chart displays the opening and closing prices of an asset, providing a comprehensive overview of its performance. By studying the past performance of an asset, it is often possible to recognize a recurring pattern. Traders can keep track of how assets behave over time and use this information to make informed decisions while buying or selling call/put options. Analysis of past financial trends helps investors understand the risk associated with their investment choices. These trends can assist them in assessing how much prices could be changing on certain assets over time.

5. The Straddle Strategy

The straddle strategy should be employed with the news strategy to gain maximum advantage. Straddle trades should be initiated prior to major announcements for maximum benefit. After the announcement is made, the asset’s value may go up temporarily. however, if you want to benefit from a lower price once again, you will need to buy an option that estimates this price decrease. Once the price starts decreasing, it’s best to move on to something else with hope that the price will eventually increase again. You can make profits by identifying and capitalizing on the upward/downward swings of the market without worrying too much about the prices of your options.

6. Fundamental Analysis

Various day traders employ this technique to increase their accuracy in analyzing an asset. It is more of a tool than a strategy as it assists them in understanding it in greater detail. This plan focuses on obtaining detailed information about an asset which can strengthen your financial gain in the future. If there is an asset that you do not know much about but the market surrounding it appears to be unpredictable and possibly rewarding, then consider investing a small amount of money into it. Experiment with a trading strategy to check its profitability. If the analysis results are positive then invest a larger sum to make more profits.

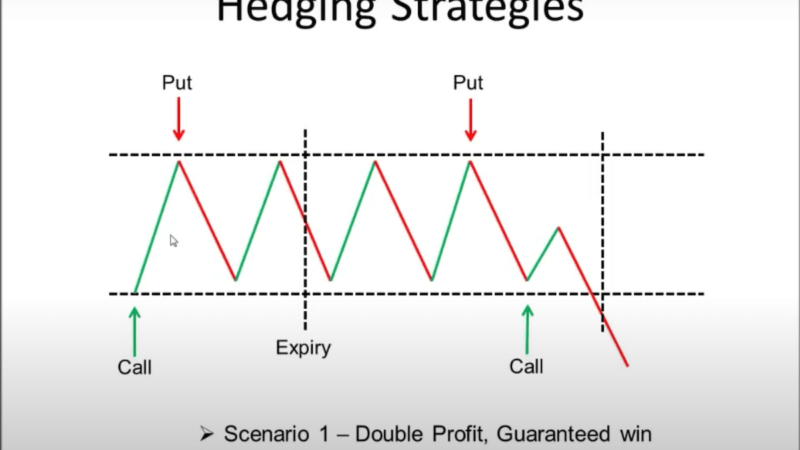

7. The Hedging Strategy

For those new to the industry, a basic but sometimes unreliable approach is worth exploring. Hedging is a strategy wherein an individual simultaneously buys and sells an asset, by placing both a call and a put option. This method helps minimize the risk of substantial losses from any unexpected market news or shifts. Even if the price of your investments changes, you are still likely to make a profit. Before investing in options, it is important to carefully consider the risks and costs associated with potential losses. This will limit your chances of facing financial losses when the time for your trades expires.

Money Management strategies

When it comes to risk management, there are two foundations: strategy and money management. Both of these components are essential in reducing risks and getting the desired outcome. To minimize risks, it’s important to only go after favorable signals, discard those that seem risky and never invest more than what you can afford in one trade. That way, you’ll be able to keep your account intact.

Money management is an essential element of successful trading. It involves controlling your overall trading fund, determining optimal trade sizes and developing a long-term financial plan. A carefully designed financial management plan should make it easier to:

- Trade size

- Risk management

- Future growth

- Stress

An individual trader needs to prepare a comprehensive financial plan in order to make sound decisions and pursue their objectives successfully. This plan should include considerations such as how they will fund their trades, the necessary size of each trade and how they can maximize their investments based on their progress. Having a well-defined strategy for managing the capital allows these decisions to be made with greater precision and accuracy.

Japanese Candlesticks for price analysis

Japanese Candlesticks are the most popular technique for analyzing price charts and are used by many traders. They provide a clear picture of the price movements over a given period of time. Reading candlestick charts provides a clear and concise picture of open, high, low and close prices in a way that other charting methods can’t match. Japanese Candlesticks are a popular choice among traders for analyzing the market. They are often used in various price action strategies and can provide signals to confirm other indicators. Their simplified design allows for a quick and efficient review of market data.

Support And Resistance level

Resistance levels are key price points on an asset’s chart that may impede further ascent when they are hit. These points can be used in predicting future price movements of the asset. When prices stop declining, it is seen as an indication of buyers entering the market – this phenomenon is known as ‘supporting prices’. This implies that a certain level of price has been maintained and buyers are preventing the price from going below it. Resistance occurs when prices stop increasing, as this is usually due to a sudden influx of sellers (or lack of buyers) in the market. Therefore, they are seen as resisting higher prices. Horizontal lines can be used to identify possible entry points and price reversal levels. Therefore, they are excellent areas to watch out for when analyzing the market.

Trend Lines in technical analysis

Technical analysis often uses lines to chart the highs and lows of an asset’s price as it moves in different directions. These lines can also help identify potential buying or selling points for the asset. A sustained uptrend in the stock market is indicated by a consecutive series of higher highs and higher lows, which usually signals that prices will continue to go up. On the other hand, when lower highs and lower lows are seen for a period of time, it indicates that prices are more likely to go down, which implies a downward trend. Tracking the trend line can be beneficial in multiple ways. It serves as a signpost, providing support and resistance and also as an entry point for traders who want to follow the trend.

Moving Averages

Moving averages give you an indication of the general trend of an asset’s price over a certain number of days by averaging its prices and plotting it as a line on the chart. Moving averages are a frequently used analytical tool for traders and investors to identify trends, set support and resistance levels, and obtain trading signals. Moving Averages are a commonly used analysis tool and there exist a multitude of methods to produce them. Common examples include Simple Moving Averages, Exponential Moving Averages, and Volume Weighted Moving Averages. they provide a reliable time frame analysis, allowing you to identify crossover signals easily at any given time. Moreover, their versatility allows multiple time frame analysis from short-term to long-term.

Oscillators

Oscillators are a key component of technical analysis, possibly the most utilized indicator of all. Oscillators are a type of financial indicator used in technical analysis, which includes tools like MACD, stochastic, and RSI among many others. Technical indicators like price action and moving averages are regularly employed by these tools to determine the current state of the market. Technical indicators are used to decipher market conditions and make informed trading decisions. They provide essential information such as determining trend direction, support and resistance levels, momentum strength, etc., which can be illustrated by a line ranging from two extremes or above and below a central point.

Trading Psychology

Emotions often have a significant impact on decision-making when trading, as it plays a crucial role in the process. An absence of assurance can lead to skipped trades or investing an inadequate sum of money in different trades that actually turn out to be prosperous. Going overboard and having too much confidence in trading can be a recipe for disaster. This can lead to overtrading or higher-risk investments, and can easily deplete your account in no time. The mental state and attitude of a trader are both incredibly important. They can be actively regulated or at least monitored to ensure the best results. Trading requires more than just financial knowledge; having a few key skills can be beneficial in this field as well. Investing time to develop these abilities is essential and should not be overlooked.

Basic Binary Options Strategy

To achieve success in binary options trading, having a basic strategy is essential. This involves understanding the different types of trades available when to enter and exit them, and being aware of the potential risks and rewards involved with each one.

Here is an illustration of some essential guidelines for creating a successful binary options trading strategy.

- Following a trend can be beneficial for traders, and the best way to do so is to enter the market when a trend starts. This way, you may be able to take advantage of potential profits from the trend.

- When you’re looking at a price chart, it’s best to enter long when prices are near support in an uptrend and to enter short when prices are near resistance in a downtrend. This way you can maximize your chances of success.

- An essential practice for successful trading is to wait for a confirmation candle signal when prices are close to the support/resistance lines in order to get the most accurate results.

- If you spot a candlestick signal in the market, wait for the stochastic or MACD to confirm. A bullish crossover during an uptrend or a bearish crossover during a downtrend is usually a positive sign.

- If criteria 1 to 4 are fulfilled, you can proceed with the trade. It is recommended to use only 3% of your available capital on each trade. When setting an expiration for a trade, it is beneficial to use twice the length of the candle size. For instance, if you are using one-minute candles, then select two minutes as the expiry; similarly, opt for two hours if you are using one-hour candles.

- It is essential to review any unsuccessful trades and make necessary adjustments before attempting a new trade. If the trade does succeed, move on to the next opportunity without delay.

Top Brokers

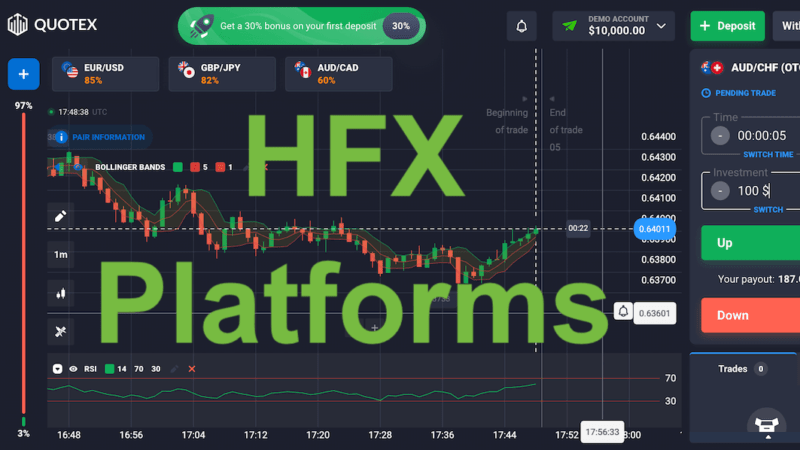

Trading binary options with a reliable trading platform is an essential component to success. With the right binary platform, you can make informed decisions, test strategies, and make profitable investments. Here, we have compiled a list of the best trading platforms for binary options trading. From beginner-friendly options to advanced ones that offer more features and customization, each of these platforms has something unique to offer for any kind of investor.

| Broker | Max. Payout | Min. Deposit | Bonus | Rating | Free Demo | Official website |

|---|---|---|---|---|---|---|

|

98% Payout | 10$ Min. Deposit | 70% Bonus | 5/5 Rating | Demo available | Visit Broker |

|

95% Payout | 20$ Min. Deposit | Up to 200% Bonus | 4.5/5 Rating | Demo available | Visit Broker |

|

95% Payout | 10$ Min. Deposit | No bonus | 4.5/5 Rating | Demo available | Visit Broker |

|

92% Payout | 50$ Min. Deposit | 50% Bonus | 4.4/5 Rating | Demo available | Visit Broker |

|

95% Payout | 250$ Min. Deposit | Up to 200% bonus | 4.3/5 Rating | Demo available | Visit Broker |

|

95% Payout | 250$ Min. Deposit | Up to 200% bonus | 4.3/5 Rating | Demo available | Visit Broker |

|

90% Payout | 10$ Min. Deposit | No bonus | 4.2/5 Rating | Demo available | Visit Broker |

|

90% Payout | 10$ Min. Deposit | No bonus | 4.1/5 Rating | Demo available | Visit Broker |

|

90% Payout | 10$ Min. Deposit | No bonus | 4/5 Rating | Demo available | Visit Broker |

Choosing a Trading Strategy

Binary options trading is a great way to make money, but it’s important to be aware of the different kinds of trade contracts, their expiries, and asset behavior. Knowing about these factors can help you maximize your profits and reduce your risk. It is essential to understand the basics of how binary options trading works before entering into any trades, such as understanding the different types of contracts available, expiry dates, and asset behavior. Having a good understanding of these areas can help you make more informed decisions regarding trading binary options.

Unlike forex trading, binary options require a lesser degree of price movement in favor of the traders to generate profits. This makes the binary options market unique in comparison to other financial markets. In addition to the Up/Down trade, which is based on direction and replicates buying and selling in other markets (minus the pip movements), there are other trade types in binary options trading that can be traded using a different set of rules. Depending on the platform, various trading contracts can be made available to users. When trading binary options, you don’t always need to guess the right direction of the asset to make a successful trade. In fact, some contracts don’t require you to do this at all. For example, with the OUT contract, an investor can make a profit if the asset price goes beyond either of the predetermined boundaries. A trader needs to be able to identify an appropriate trade agreement in order to design a fitting strategy. Different trading methods are used for the Up/Down and In/Out contracts, so it is important to know which one is applicable in each situation. The way the binary option contract is structured will shape the approach you’ll use.

To trade the Up/Down contract, a strategy must be set in place to determine whether the underlying asset will go up or down in value. Trading the In/Out contract involves either utilizing a range trading technique or a breakout trading method to recognize when the asset remains within its range or breaks out of it. To develop an effective In/Out strategy for trading, you need to think about the details of your strategy from a logical and analytical perspective.

To construct an effective trading strategy using binary options, traders can utilize certain tools to help gain an advantage. These resources provide insights into the markets and assist in decision-making processes. Chart patterns, signals services, candlesticks, and technical indicators can be used to help make decisions when it comes to managing investments or trading. The pivot point calculator is a great tool for traders looking to use the TOUCH trading strategy, as it can bring very good results. It is simple to use and gives traders an advantage. After selecting a strategy, tools like these can help us to understand how to determine appropriate expiry times. This is a necessary step in any successful binary trading process.

Understanding Expiry Times

Binary options trading is highly dependent on expiry times. Every trade must be completed within a set period of time in order for the contract to be valid. Consequently, it is essential to manage expiry times effectively. It is possible to be successful in trading binary options without the use of time limits. With Up/Down trades, you won’t know the outcome until the trade reaches expiry. Certain types of binary options trades, such as the OUT and TOUCH components of the High Yield Touch or Touch/No Touch trades, can be completed before they reach maturity to determine the outcome of the trade. If a trader bets that an asset will touch or exceed a certain strike price before expiry, and it does so, the trade is terminated as soon as the target is met and the trader earns a profit.

If a trader is unfamiliar with setting the correct expiry times/dates, their binary options trading strategy should focus on trades that are not entirely reliant on expiry date accuracy. This way, mistakes will not hurt trades as much and the strategy can remain profitable.

By differentiating between trades that are not as dependent on expiry dates, and ones that are, you can gain a better understanding of the type of strategy you would need to employ. This aids in making informed decisions and enables more advantageous trading.

Understanding Asset Behaviour

Binary options trading brings together various assets from diverse categories into a single market. It’s important to note that these assets behave differently from each other. Some financial instruments can be quite unstable, resulting in large changes in price within a single trading day. A example of this type of volatile assets is bitcoin and cryptocurrencies. Certain binary options assets are only available to trade during certain times of the day such as stock indices. This means that you cannot buy or sell them 24/7. It’s important to know when these assets are available so you can plan your trading accordingly. The catalysts of a drastic shift in stock indices vary from those which drive changes in commodities and currencies. Therefore, they cannot be assumed to be the same. Every asset has its own characteristics and no two investments respond to market changes in the same way. Therefore, it is important to evaluate each instrument individually when making an investment decision.

In order to devise a successful trading plan, an in-depth knowledge of how assets behave is essential. As a trader, it is essential to research the behavior of assets, comprehend the fundamental and technical indicators that will have an impact on asset behavior and cost variations, and construct an effective trading strategy for that asset.