Fibonacci Retracement strategy in binary option trading

When trading binary options, the procedure may be finalized rapidly because it is based on the simple premise of yes or no. Traders who are well-versed in the market, up-to-date on the newest financial news, and observant of price trends can assess the proposition.

However, how can one go about doing so, given the structure of the binary options market? Using technical indicators is the way to go. To better understand market patterns, traders use indicators, which can be thought of as the numerical values displayed on charts and graphs.

With the use of technical indicators, investors may gain a deeper knowledge of the market and make more profitable entry and exit decisions. Depending on their characteristics, the indicators can be classified as momentum, volatility, trend, or volume. The four different types are as follows.

Considering all the options, it shouldn’t be too hard to choose an appropriate technical indicator. In contrast, if you want to use an indicator that will help you anticipate future price reversals, Fibonacci Retracement is the way to go.

People of all ages shouldn’t use this indicator. But if it’s put to good use, one can accurately forecast how an asset’s price will change in the future.

Can one possibly produce a blunder when utilizing this trading instrument? Just what are some of the drawbacks of it? Specifically, how may this help you while working with binary options? If you have questions like these, among others, you may find the answers by reading on.

Contents

What is the Fibonacci Retracement, exactly?

To better understand the dynamics of the binary options market, many traders turn to the Fibonacci Retracement, a strong tool for technical analysis. A moving average indicator and the moving average convergence/divergence (MACD) indicator are two other technical indicators with which its functionality is on par.

One of the things that distinguishes the Fibonacci Retracement unique from other comparable tools is its history. The mathematical observations used in this device are many centuries old. The tool helps traders foresee the likely locations of support and resistance.

Since it aids in the creation of a simple and uncomplicated strategy, Fibonacci Retracement has lately gained popularity among traders. With this indication and a price-versus-time chart, any trader may keep tabs on the value of a certain asset or binary option.

What are Fibonacci Retracement levels?

The Fibonacci Retracement levels, shown on the chart by horizontal lines, are drawn like such. These lines on the chart denote the support level and the resistance level. These tiers are derived from the Fibonacci sequence and are represented as percentages.

This percentage indicates the extent to which the current price has returned to its previous level after an earlier price change. 23.6%, 38.2%, 50%, 61.8%, 78.6%, and 100% make up the six levels. The golden ratio of 50% is also a Fibonacci sequence proportion. However, the proper authorities have not approved it. These percentages might help a trader identify areas of the chart where an asset’s price is likely to reverse direction or become rangebound.

Fibonacci-Retracement-levels

Market participants can use the Fibonacci Retracement indicator to draw a line between two significant price levels, such as the low and high points of an asset’s price range. After that, the indicator will produce a level halfway between the two prices.

Here’s an example: the price of a piece of property increases by $10 but then decreases by $2.36. One possible interpretation is that the price has retraced by 23.6%. Fibonacci Retracement is also used to determine the stop loss level, place entry orders, and set price targets.

For those looking for a reliable binary options trading platform, the best choice is:

| Broker | Max. Payout | Min. Deposit | Bonus | Rating | Free Demo | Official website |

|---|---|---|---|---|---|---|

|

98% Payout | 10$ Min. Deposit | 70% Bonus | 5/5 Rating | Demo available | Visit Broker |

|

95% Payout | 20$ Min. Deposit | Up to 200% Bonus | 4.5/5 Rating | Demo available | Visit Broker |

|

95% Payout | 10$ Min. Deposit | No bonus | 4.5/5 Rating | Demo available | Visit Broker |

|

92% Payout | 50$ Min. Deposit | 50% Bonus | 4.4/5 Rating | Demo available | Visit Broker |

|

95% Payout | 250$ Min. Deposit | Up to 200% bonus | 4.3/5 Rating | Demo available | Visit Broker |

|

95% Payout | 250$ Min. Deposit | Up to 200% bonus | 4.3/5 Rating | Demo available | Visit Broker |

|

90% Payout | 10$ Min. Deposit | No bonus | 4.2/5 Rating | Demo available | Visit Broker |

|

90% Payout | 10$ Min. Deposit | No bonus | 4.1/5 Rating | Demo available | Visit Broker |

|

90% Payout | 10$ Min. Deposit | No bonus | 4/5 Rating | Demo available | Visit Broker |

How Fibonacci Retracement levels be calculated?

The amount of a Fibonacci retracement cannot be determined with any precision, unfortunately. However, you may still calculate its location if you use two extreme places as your anchors. The next step is to draw a line that logically links the two points provided.

A trend line is a line drawn between two places, so called because it shows the general direction of prices between them. Changing the percentage allows for a variety of line styles to be achieved.

The price of an item, for instance, may go from $10 to $15. These two positions can be used as the beginning and finishing points of a retracement indicator. An immediate calculation is needed to ascertain the sum that accounts for 26.4% of the subject in question.

$15 – ($5 x 0.236) = $13.82

If you’re a trader, you may use this figure to determine that the item’s 23.6% profit margin is at the $13.82 pricing point.

To what extent may the Fibonacci Retracement be useful in binary options trading?

In order to use the Fibonacci Retracement tool, traders must draw percentage lines on the chart. The locations of potential price changes in the market may be better predicted with the help of these lines. You may use this data to estimate when you should purchase or sell binary options.

The following three rules should be kept in mind by traders while using the Fibonacci Retracement tool.

Fibonacci We cannot draw any conclusions about the future based on the extent of the current correction. This is because the signal is most likely to appear at this point in the market for trading binary options.

As the price approaches one of the retracement percentages, signals that emerge at that level are more reliable than those that appear at other levels. Sometimes, though, a robust signal is picked up between two lines.

In the event that the retracement level on the trade chart is breached, even temporarily, the target will shift to the level just below it. If the current level is higher than the previous one, the move will continue in the same direction.

How to use Fibonacci retracement levels?

An explanation of the Fibonacci sequence and its use in determining retracement levels

If you want to maximize your profits from using the Fibonacci Retracement, it’s important to remember a few factors.

Gold, the Euro-U.S. Dollar currency pair, and other strongly trending financial goods should constitute the bulk of your trading activity.

Use a reliable time frame, such as a daily chart, to get the most accurate results.

You may learn more about the dynamics of ma by looking at its historical price changes. To calculate the retracement level, for instance, you may calculate the item’s price increase from its minimum to maximum potential value. Seeing the price drop in the context of its subsequent upward movement following an increase can help you make sense of it.

To get the retracement level, you may also calculate the price drop from the highest to lowest point. This level denotes the moment at which the price of an asset reversed course after initially falling and then continuing to move in a downward direction after the initial decline.

Traders betting on an upward trend will use previous buying patterns as a guide. Similarly, the selling pattern is used by traders who are betting on a market decline.

Fibonacci-Retracement-levels-support

Can I trust the Fibonacci Retracement tool?

Fibonacci Retracement is an excellent tool for forecasting future asset price movements, but it is not foolproof. This is because it comes with quite a few limitations.

The information and lines on the chart might be used by a novice trader using the Fibonacci Retracement tool to learn more about the binary options market. In contrast, a competent trader would continuously adjust the lines in order to hone in on more specific data.

Furthermore, the binary options market is highly unpredictable. Therefore, it becomes quite challenging to foretell the precise position of an asset or its future price movement. There is a much higher potential for loss when trading using this sort of information.

Furthermore, the Fibonacci Retracement level does not provide the particular instant when the market’s price started to move. You might be able to get ballpark figures, but don’t consider them as gospel until you’ve confirmed their accuracy.

To rub salt in the wound, the Fibonacci Retracement is based entirely on formulae and numbers. Despite its derivation from the well-known Fibonacci sequence, the computation makes no sense.

The lack of a clear development in the Fibonacci Retracement might make it seem like a confounding indicator to traders who prefer a more rational approach.

Fibonacci retracement on Tading platform

When trying to determine how much anything is worth, the Fibonacci Retracement is, without a question, the best tool available. On the other hand, traders may be intimidated by all the numbers and ratios they need to keep track of.

However, you may use a powerful broker tool that comes with advanced charting software to simplify and speed up the process of conducting all of the essential calculations.

Famous brokers offering Fibonacci chart patterns include those listed below.

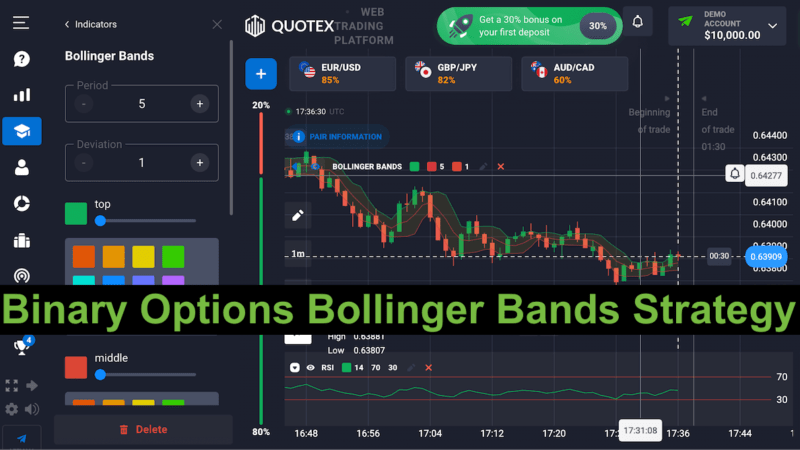

If you’re looking for a trading platform with a lower barrier to entry, Quotex is your best bet. We ask for a bare minimum of $5 to get started. Once you’ve made your initial deposit, you’ll be able to try out the service with a “play money” account.

When trading options on Quotex, you can count on a payout rate of 98%, the highest of any options trading platform. This is because Quotex dominates the industry. However, this broker is not officially recognized by law enforcement.

IQ OPTION

Popular binary options trading platform IQ Option is governed by the Cyprus Securities and Exchange Commission (CySEC). There is a ten dollar minimum deposit with this reliable broker. After making your initial deposit, you’ll be able to start trading with IQ Option using the Fibonacci chart patterns

After making the minimal deposit, you’ll unlock access to the demo account. Furthermore, IQ Option offers a payout rate of 90% of your initial investment.

To open a free trading account with IQ Option, please click here. (Warning: There is a potential loss of principal)

RaceOption

You may use RaceOption, another trading platform at your disposal, to make investments in the binary options market utilizing the Fibonacci chart patterns provided by RaceOption. Since its launch in 2014, the company has offered consumers a payout rate of up to 95%.

The bare minimum to get started trading with RaceOption is $250. Although this broker’s fees may seem excessive at first glance, they are definitely worth it once you learn that, depending on how much you pay, you’ll have access to not one but three separate trading platforms.

Get in contact with RaceOption, a broker, to open a free trading account (Risk warning: You capital can be at risk)

Conclusion

Many investors study the binary options market by employing the Fibonacci Retracement, a popular and widely-used trading strategy. Traders can use the Fibonacci sequence to get a feel for the broader movement of an asset’s price.

However, one should not place too much stock in these figures because they do not disclose the exact instant when a product’s price suddenly spiked. Further, market players can’t just disregard the fact that this signal has some limitations.

Nevertheless, when all factors are considered, the Fibonacci Retracement is a fantastic method that might aid you in reaching your trading goals.