EUR/USD Binary Options trading strategy

It is possible to have difficulty determining which asset is most suitable for trading binary options. Traders who are just starting out will have a significantly harder time selecting assets since they lack past experience.

Trading with foreign currency carries the least amount of risk in comparison to trading in commodities, indexes, and stocks. Regardless of your level of experience in trading, you should put this currency pair at the top of your priority list if you are wanting to conduct a transaction that is risk-free.

In addition, the relatively low amount of collateral helps to keep the foreign currency market from being too volatile. In addition, the substantial gains that may be made through foreign exchange trading make it a more alluring choice.

You have the ability to choose from more than 11 currency pairs while engaging in forex trading utilizing binary options. The exchange rates in question are the British Pound to US Dollar rate, the Euro to US Dollar rate, the Australian Dollar to US Dollar rate, the exchange rate between the British Pound and the Japanese Yen, the exchange rate between the Euro and the Canadian Dollar, the exchange rate between the Japanese Yen and the US Dollar, and the exchange rate between the Canadian Dollar and the US Dollar.

The pairing of the Euro with the US Dollar is consistently regarded as one of the most reliable options. Trading with this pair might result in an increase in your profits.

But at what point in time does it make the most sense to swap the euro for dollars? Or, whatever trading strategy would you recommend for dealing with this currency pair? This manual contains the answers to all of your inquiries and concerns.

Contents

How does forex trading work?

It is essential to have a solid grasp of a few fundamental ideas prior to engaging in transactions on the foreign exchange market.

- The term “base currency” refers to one of the currencies in a currency pair, while “quote currency” refers to the other currency in the pair. As an instance, in the EUR/USD exchange rate, the Euro is considered the base currency, while the Dollar is considered the quote currency.

- The movement of the base currency in relation to the quotation currency is displayed on the trading chart for foreign exchange.

- When comparing different currencies, the value of the base currency is always equal to one. When the value of the EUR/USD currency pair is 1.11, it means that 1.11 US dollars are required to acquire one euro.

When compared to other assets, currency pairs are unique in that they may be exchanged at any time of the day or night thanks to a global network of institutions that helps to facilitate the market. In addition, there are three separate types of markets that are utilized in forex trading. These markets include the spot market, the futures market, and the forward market.

In addition, the difference in value that occurs between two currencies is measured in pips. The term “pip” is used in this context to refer to a percentage point.

The Euro to Dollar Chart on TradingView

How exactly might trading the EUR/USD with Binary Options help you make a profit?

The exchange rate for the Euro to the Dollar is the currency pair that is exchanged the most frequently and is considered to be one of “The Significant” group of major currency pairs.

Because it provides trading in several time frames, the Euro-Dollar trading technique is an excellent option to consider. Because it is actively traded at all hours of the day and night, this currency pair has a high level of liquidity. Prices tend to become more reasonable when there is an increase in liquidity.

You have the choice of trading the EUR/USD pair using either the High/Low or Touch/No Touch binary options trading strategies. Both of these strategies are equally effective. If you open an account with IQ Option, RaceOption, or Quotex, you have a better chance of realizing higher earnings from trading in this currency pair.

Best binary options brokers for Eur/usd trading

| Broker | Max. Payout | Min. Deposit | Bonus | Rating | Free Demo | Official website |

|---|---|---|---|---|---|---|

|

98% Payout | 10$ Min. Deposit | 70% Bonus | 5/5 Rating | Demo available | Visit Broker |

|

95% Payout | 20$ Min. Deposit | Up to 200% Bonus | 4.5/5 Rating | Demo available | Visit Broker |

|

95% Payout | 10$ Min. Deposit | No bonus | 4.5/5 Rating | Demo available | Visit Broker |

|

92% Payout | 50$ Min. Deposit | 50% Bonus | 4.4/5 Rating | Demo available | Visit Broker |

|

95% Payout | 250$ Min. Deposit | Up to 200% bonus | 4.3/5 Rating | Demo available | Visit Broker |

|

95% Payout | 250$ Min. Deposit | Up to 200% bonus | 4.3/5 Rating | Demo available | Visit Broker |

|

90% Payout | 10$ Min. Deposit | No bonus | 4.2/5 Rating | Demo available | Visit Broker |

|

90% Payout | 10$ Min. Deposit | No bonus | 4.1/5 Rating | Demo available | Visit Broker |

|

90% Payout | 10$ Min. Deposit | No bonus | 4/5 Rating | Demo available | Visit Broker |

Why no trade EUR/USD?

This trading pair, like with other assets, is subject to limits in the same manner that other assets are. I’ll provide a list of some of them down below.

- Because of the extremely high volume of trades that take place in the EUR/USD currency pairing, it is consistently ranked as one of the most volatile pairings in the whole globe. When there is a high level of volatility, there is a greater possibility that a transaction that began with a profit would finish with a loss. Even if you are well-versed in the foreign exchange market, it is possible that you may still find it difficult to forecast the volatility of the EUR/USD exchange rate.

- Trading on margin can lead to increased profits, but it also significantly raises the stakes in terms of the potential for loss.

- The dollar and the euro are not totally trading in tandem at this time.

The trading time for the United States Dollar and the European Currency

Trading the most powerful currency pair at the most advantageous time is absolutely necessary in order to maximize earnings.

Commercial activity in the Eurozone (07.00-16.30 UTC)

Before 10:00 UTC, Asian traders have a considerable influence on the direction of trading in the currency pair since they lock in their profit and loss at the closing of their deal. It is also important to keep in mind that the price will go down quite a bit before the opening of the American market.

Meeting Between Representatives from the United States and Europe (13.30-16.30 UTC)

Important new information about the relationships between currencies is often published in the United States around this time. It is possible that the market’s response to this issue will cause it to plummet or skyrocket. In addition, American businesses are responsible for between sixty and seventy percent of the world’s total commercial activity.

America (13.30-20.00 UTC) (13.30-20.00 UTC) (13.30-20.00 UTC)

The shift away from the euro and toward the dollar at this moment gives the dollar a boost.

Asia (20.00-07.00 UTC) (20.00-07.00 UTC) (20.00-07.00 UTC)

The turnover of EUR experiences a drop at this time. As a direct consequence of this, investors are choosing to wait it out until the European markets open.

Forex trading strategy for the EUR/USD currency pair

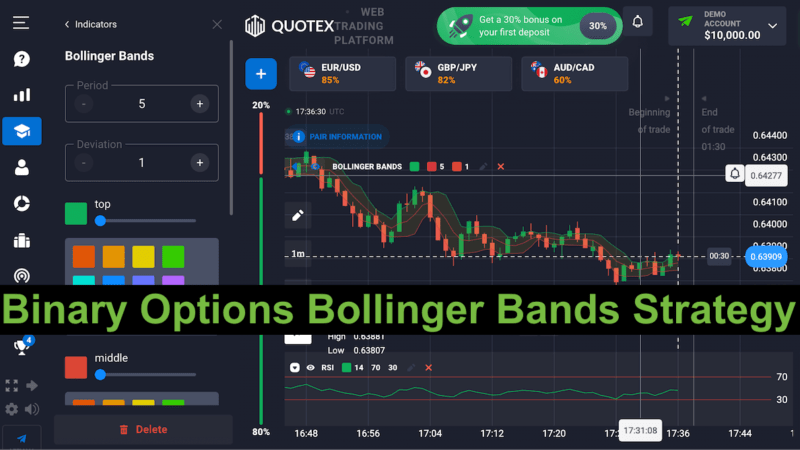

Charting activity for the EUR/USD currency pair on the Quotex trading platform

Trading EUR/USD pairs can potentially yield considerable gains for investors, provided they employ the appropriate strategy.

Timing

If you are familiar with the characteristics of the EUR/USD pair, you will be able to trade it at the most advantageous moments. You can choose to trade for a period of five minutes, thirty minutes, five days, or twenty-four hours.

You may trade foreign exchange at any hour of the day or night, but doing so is fraught with peril and is not advised. As a consequence of this, you ought to refrain from entering any trades until the EUR/USD currency pair is actively trading before you do so.

If you enter or leave the transaction at the wrong time, the potential gain might turn into a loss instead. If you want to trade the EUR/USD successfully, the best time to do it is between 13:00 and 16:00 GMT. At this hour, both the London and New York stock markets are open for business.

Minimal Patten Ranges

By joining the market during periods of consolidation, you can lower the danger of experiencing a loss. A narrow trading range is created when the exchange rate of two currencies either drops or increases and then remains relatively stable after that. When there is a consolidation in prices, volatility tends to reduce.

Maintain a current awareness of the most recent market news emanating from both Europe and the United States.

The announcement might be interpreted as a gauge for the exchange rate between euros and dollars. Whether or not you are current on the latest financial news is a significant factor in determining whether or not you should trade the currency pair in question.

Keeping up with the news coverage of a currency pair may provide you with valuable insight on the performance of the pair.

Conclusion

Even if the Euro to Dollar exchange rate is among the strongest, it is still prudent to use some degree of care. This is due to the fact that trading EUR/USD is subject to specific volatility and might result in significant financial losses.

You need to pay attention to market news, choose the ideal timing to join the market, and come up with a sound strategy if you want to be able to execute trades that are lucrative.

Even unskilled traders may be able to earn a profit if they have a solid understanding of the EUR/USD currency pair and collaborate with a trustworthy broker.

Look at some of my other approaches as well.