What is HFX trading ? The Complet guide

Forex trading and share trading for beginners share many of the same core notions when it comes to trading. That holds true for both stock and forex trading.

Beginning traders in HFX or forex in general would do well to do extensive research before joining the market. If you know the advantages and disadvantages of HFX Trading, you can make better decisions about which strategies to employ.

In this article, we will discuss the essentials of HFX trading that every newcomer should know. Everything you need to know to make it as a successful trader in foreign currency, from the basics to advanced techniques.

Contents

What Is HFX Trading?

The term “HFX trading,” is commonly used by those (Forex Traders) who actively engage in the frenzied buying and selling of foreign currency.

This describes situations in which a trader attempts to purchase or sell a currency in order to profit from a change in that currency’s price. Another group would be hedgers who want to safeguard their funds from the potential adverse effects of a change in exchange rates.

Forex traders include, but are not limited to, individuals using retail platforms, banks using institutional platforms, and hedgers who either manage their own risk or hire a bank or money manager to do so.

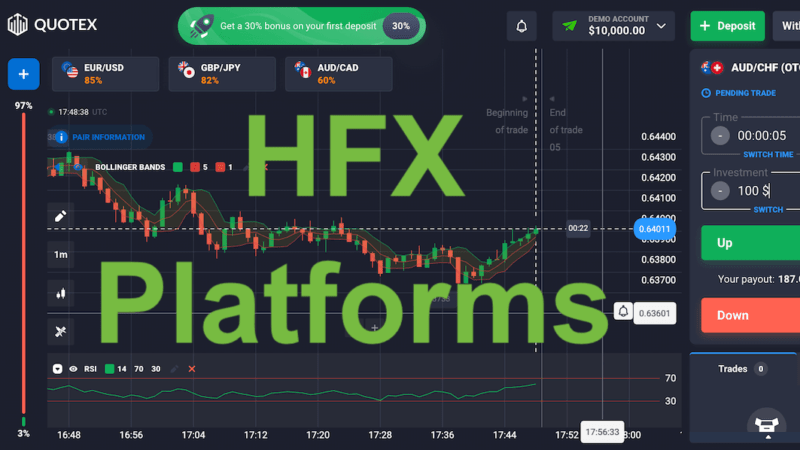

To begin with: Always go with a reputable HFX trading platform:

| Broker | Max. Payout | Min. Deposit | Bonus | Rating | Free Demo | Official website |

|---|---|---|---|---|---|---|

|

98% Payout | 10$ Min. Deposit | 70% Bonus | 5/5 Rating | Demo available | Visit Broker |

|

95% Payout | 10$ Min. Deposit | No bonus | 4.5/5 Rating | Demo available | Visit Broker |

|

92% Payout | 50$ Min. Deposit | 50% Bonus | 4.4/5 Rating | Demo available | Visit Broker |

You’ll need both a trustworthy broker and trading platform to get involved in the HFX market. All current brokers do not provide these kind of short-term contracts (digital option).

What are the advantages and disadvantages of HFX Trading

Like many other sorts of trading, HFX trading may have advantages and disadvantages for traders. Anyone who is just starting out in the trading market and is considering forex trading should weigh the pros and cons of the market carefully before making a decision.

Advantages

- Availability

- Application of leverage

- Potential for quick gain

- Easily executed short trade

- Availability of High liquidity

- Methodology used in actual situations

- Pricing can be less easily manipulated.

- Low fee.

- Simplified tax report

- Computerized and automatic trading system

Disadvantages

- Challenges faced by start-ups and small businesses

- A less restrictive approach to regulating

- Highly competitive market

- Low margin return

Below, we list the pros and cons of trading HFX and will go into further detail about each later on in this piece. Trading in HFX has several benefits.

Here are some of the many upsides of FX trading:

Availability

The foreign currency market is among the most approachable trading venues for novices (Forex). A dealer may create a forex account for as little as £50, and it will be functional in one to three business days. Actual market pricing, information, tools, price charts, and trading strategies are all made available to users of electronic trading platforms. Nowadays, internet trading is offered by nearly every broker.

Second, it is more easier for traders to include forex trading into their daily routines than other forms of trading since the foreign exchange market is available for trading 24 hours a day, five days a week (albeit not on the weekends).

Application of leverage

The ability to use leverage when trading might be the difference between a modest profit and a sizable one. The leverage available for use in HFX transaction is exceptionally high in comparison to those of other markets. Traders may be able to receive a margin that provides a leverage ratio of 100 to 1 or more for initial capital invested in trading, depending on the market in which they engage.

Potential for quick gain

High degrees of volatility and quick movement are hallmarks of the foreign exchange market. These features, coupled with the increased leverage available to forex traders on a regular basis, suggest that the foreign exchange market may provide traders with the chance for faster profits than other markets, where traders may be required to wait for asset value growth and profits from assets traded over the long term. This is useful in the HFX market since a reduction in the forex trader’s exposure to investment risk is a direct result of the market’s rapid pace.

Gain are possible on all price direction

Unlike buying currencies on the currency market, which is much easier to enter, selling short in other markets frequently requires acquiring assets and running the risk of being bailed out of a single stock by the borrowers. Since currency transactions usually occur in pairs, each time a trader want to acquire any money they must first dispose of another. To hedge against the depreciation of a currency, a trader need just sell that currency and utilize the proceeds to buy another pair of currencies, with little or no need for a loan.

Availability of High liquidity

The foreign currency market (FX market) is the world’s busiest and most consequential market.

The term “Foreign Exchange,” or “Forex” for short, comes from the phrase “foreign currency exchange.” Foreign exchange refers to the practice of exchanging one currency for another for a variety of purposes, the most popular of which being commercial or recreational. According to the Bank for International Settlements report, daily FX trading volume reached $6.6 trillion in 2019.

A method based on actual experience

The foreign currency market benefits from well-planned and executed trades. In contrast, currency exchange (Forex) traders can make money by doing little more than keeping an eye on price fluctuations. In contrast, stock and credit market traders may need to dig deeper into the underlying assets and issuers’ finances to ensure a positive return on investment.

Price histories and trends are the foundation of any practical study, since they show how the market sees supply and demand and how it feels about the investment in question. Practical analysis is usually focused on price histories and trends, even when basic research requires obtaining considerable background information about an investor’s financial condition.

Less Market Manipulation

There is much less room for internal pricing manipulation.

Private information held by stakeholders and insiders of an asset can have a significant impact on the stock market, credit markets, and even futures markets.

In contrast, the currency market does not appear to be in any immediate danger.

Due to the huge amount of trading that takes place in the system, it is impossible for unethical traders to manipulate the price of a currency within the system. With this system in place, investors with access to interbank trading may help bring the market into greater openness.

Low fee and commission

The expenses associated with trading in markets, stocks, investment firms, and other derivatives may be more than expected because of the possibility of exorbitant charges and hidden fees. These charges are not applicable to private people that engage in currency trading on the FOREX market.

Another characteristic of forex trading that makes it evident is that the deal spread, which is the difference between the ask (selling) and bid (buying) prices freely posted by brokers in real time, is typically the only element of forex trading costs.

Taxation

Unlike in other markets, where traders may need to keep extensive records of their long- and short-term trading activities for tax purposes, HFX Trader are generally subject to more straightforward tax laws that simplify the process of filing taxes.

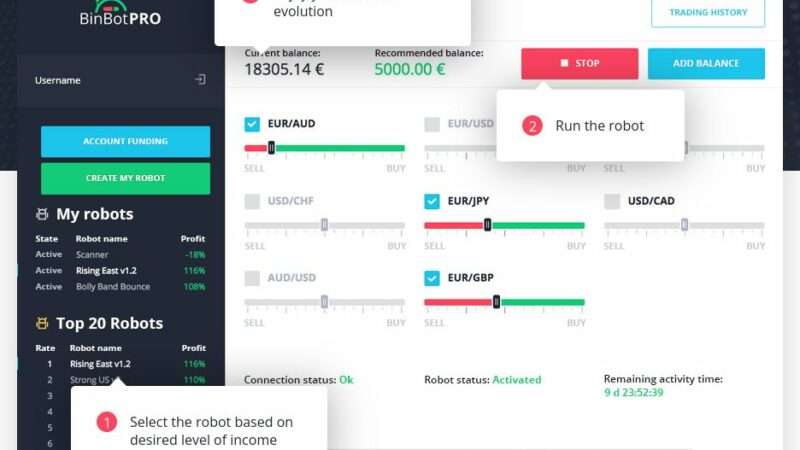

Computerized and automatized trading platform

HFX is a good fit for online trading algorithms. Setting entry, limiting prices, and stop-loss orders ahead of time is simple for forex traders. Forex traders can also train the platform to trade based on predetermined parameters, such as the level of market volatility or the current state of the currency exchange.

HFX Trading’s Downsides

To sum up, these are the drawbacks of HFX trading.

Unpredictability

No market is immune to price volatility, and the Forex market is no different. Forex traders expecting short-term profits may find their strategies unsuccessful if they are exposed to unexpectedly high levels of market volatility.

Highly competitive market

More than $4 trillion changes hands daily on the foreign exchange (FX) market, with major banks, hedge funds, and other large financial organizations still accounting for the bulk of daily trading activity.

In terms of pricing power and ability to affect market swings, these businesses may have a leg up due to their size and access to resources.

This holds true for all markets, but the Forex market in particular highlights this fact. Traders who want to make money off of currency transactions need to stay abreast of the latest developments in this extremely fluid market.

Reduced regulatory oversight

Since there is no centralized exchange for HFX trading, and regulators aren’t always keeping tabs on the market, regulatory oversight is often lax. So, before opening an account, traders might want to do some “careful investigation” into the company’s background and trading practices.

Furthermore, the absence of regulation is one of the major drawbacks of forex, since traders may have less recourses regardless of the country they trade in if they believe brokers like Quotex or Olymp Trade have not treated them properly.

Low marginal returns

Consistent dividend and interest payments made on stocks can boost their long-term value. However, the primary objective of foreign exchange trading is to gain from the appreciation of both currencies involved in a given trade.

Conversely, regular foreign currency assets may pay dividends or interest. This is determined by the interest rate spread between the countries whose currencies are being sold and purchased. Rollover interest is a term for this form of interest.

How much time do you need to become an expert HFX trader?

Since the forex market is dynamic and constantly changing, there is no end to the amount you may learn about HFX trade.

Creating your own strategy is the most important step. Try to think of innovative solutions. There is no hurry since every second counts.

After you’ve finished studying, put your newfound knowledge to the test on a dummy account.

You can use this to see if your efforts are producing positive results.

Keep in mind that this is going to take a while. There is no such thing as a waste of time, and it may take as long as two to three months.

What is the process of HFX trading?

You’ll need some familiarity with the inner workings of the foreign exchange market to make successful HFX trades, which are deceptively simple. This type of instability occurs frequently throughout the day on financial markets; for instance, supposing you anticipated a stock’s price to rise by a dollar for 10 seconds but instead it went back down.

Assuming you can buy one share of stock one second before it increases and then sell it two seconds after it has risen in price. Profits ten times the initial outlay could be made in a matter of seconds. That is, essentially, how high-frequency trading functions.

In order to assist you learn the ropes of trading on the market, a free demo account is at your disposal.

In what ways might high-frequency Forex trading help you?

The growth of computerized trading and the proliferation of high-speed computing have both contributed to a general shift in the foreign exchange market, of which high-frequency (HFX) trading is one subset.

One of the things that sets HFX trading distinct from other algo decision-makers is its ability to help traders spot profitable trading chances in the Forex market.

Get in on the HFX market right away: Register with Quotex for free today

(Risk warning: You capital can be at risk)

Can I assume that HFX trading and Binary options trading are the same?

In some ways, binary and forex trading are the same, and in others, they are very different.

Binary options are high-risk trades in which the investor predicts the price movement of an underlying asset (or currency, in the case of HFX trading) within a certain time frame.

How much profit the trader stands to make depends on whether or not the forecasts come true. If the hypothesis is correct, you will earn a return on your investment in addition to your original sum invested.

It is possible to trade HFX and binary options online with minimal capital outlay. The margin of profit you can expect to make over time is the deciding factor. If you want to see significant success with binary options, you need to improve your prediction skills.

HFX Trading terminology

HFX trading is notoriously difficult for newcomers because of the extensive usage of specialized jargon and acronyms. Getting used to trading on new platforms like Meta Trader 4, Meta Trader 5, and other platforms can be challenging, therefore familiarity with any unfamiliar materials or specialized terminology is essential. In order to strengthen your knowledge of forex trading, this article will assist you in comprehending some of the fundamental concepts.

Leverage

Leverage typically refers to funds drawn from a trading account. When using leverage, a trader can start a trading account with a massive contract size for a much lower initial outlay. You can trade your preferred Forex pairs, Cryptocurrency, and other assets with a high degree of leverage and a little initial investment.

In a pair of Swiss francs and other currencies More than 120 currencies used in serious countries are accepted in the trade community. Traders can estimate a dollar’s potential earnings by looking at a range of indicators to project its future performance on the foreign exchange market.

Our approach to foreign exchange trading is based on foreign exchange (Forex) trading, with a primary emphasis on the relative profitability of different currencies. There are primarily three types of Swissy/ currency combinations.

Major currencies fair

Eight of the most common combinations are shown below, with the US dollar serving as the “base” or “exchange” currency and one of the other currencies shown serving as the “cross” currency.

Canadian Dollar, British Pound, Japanese Yen, New Zealand Dollar, Euro, Swiss Franc, Australian Dollar.

Exotics

These lesser-known nations’ currencies tend to be more exotic and can be extremely volatile. Examples of these currencies are the Hungarian forint, the Polish zloty, and the South African rand. Pairing off

Both the base and counter currencies in these pairs are not the US Dollar. A greater degree of danger is involved compared to Major Pairs. Term 4: Ask/Bid Price

For any given currency pair, a broker’s bid price is the highest price at which he or she is willing to buy; conversely, a broker’s ask price is the lowest price at which he or she is willing to sell.

PIP

A percentage expressed as a point-in-time increment, or PIP. A point of interest point (PIP) is the tiniest increment of change in a currency exchange rate. The PIP refers to the fourth digit of a currency quote. A measure of value.

Margin

Margin is the initial trade capital outlay required by a trader.

Using margin enables a trader to take more risk in their transactions. Trading on margin requires the investor to put up only a fraction of the total value of the stake before the trade can be initiated. You can trade more aggressively, but keep in mind that this also increases the potential for both gains and losses.

How to open a HFX Trading Account

Opening a HFX Trading trading account is the first order of business.

The following pieces of information are required to establish a profile:

You’ll need to provide the following details to open a trading account: your name, address, phone number, email address, birth date, nationality, account currency, TIN, password, and job status.

All it takes to open an HFX account is a few minutes and the above information because the platform is user-friendly and quick to set up.

Get in on the HFX market right away: Register with Quotex for free today

(Risk warning: You capital can be at risk)

Can you help me decide which HFX platform is ideal for me?

There are more factors to think about while deciding on the finest High-frequency Forex (HFX) trading platform for your requirements.

It’s important to weigh a number of factors before selecting on a brokerage, as they can all have a direct impact on how profitable your trading strategy ultimately is. There are many things to think about, but here are just a few. Topics covered include: • Security and rulesets • Trial version • Payment options • Research and analysis • Demo account • Spread

Do you need an HFX broker to trade HFX?

When dealing in foreign exchange, it is essential to use a high-frequency trading (HFX) broker, such as Quotex or IQ Option.

HFX brokers streamline the trading process so that investors have more time for other pursuits. To top it all off, there are top-tier brokers that have made trading accessible even to novices.

Conclusion

One unique feature of HFX trading platforms is the availability of assets that aren’t widely available on other exchanges. The important considerations to keep in mind before making an investment with an HFX broker were also detailed. Among these are the most fundamental needs of the market, concerns over security and regulation, the need to charge for services and maintain assets, and so on.

Since there is inherent risk in any kind of foreign exchange trading, the only way to succeed at high-frequency Forex (HFX) is to develop a trading strategy that fits your individual needs. The foreign exchange market is more dynamic than we might imagine, thus it’s important to keep up with daily market developments by educating ourselves.

Get in on the HFX market right away: Register with Quotex for free today

(Risk warning: You capital can be at risk)