Options trading

Investors are able to speculate on the future value of an asset using a yes/no result while trading digital options, just as they are able to do with binary options. You will get an understanding of what digital options are, the several different types of these options that are now on the market, as well as the procedures that are required to get started trading in this potentially lucrative financial instrument during the course of this article.

Contents

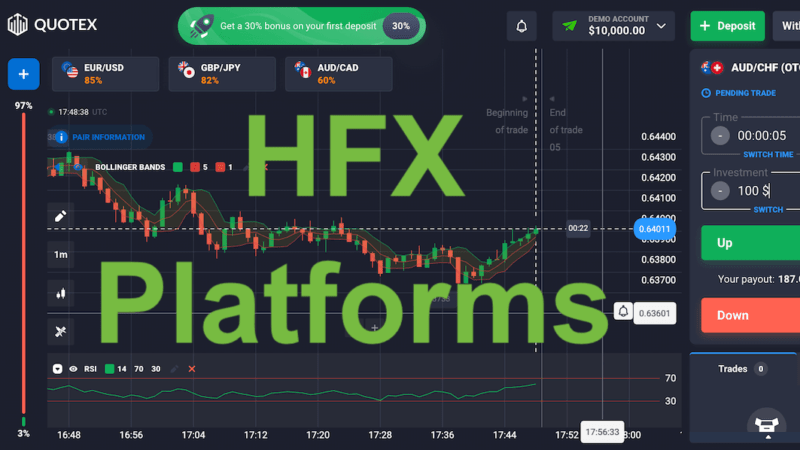

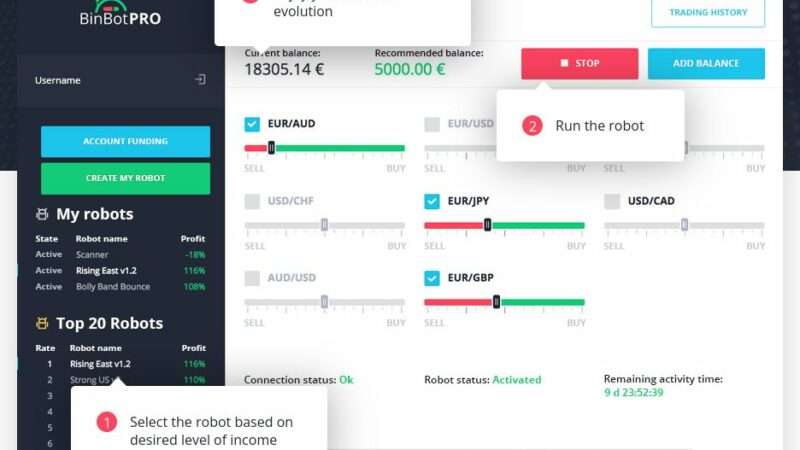

Digital options brokers

| Broker | Max. Payout | Min. Deposit | Bonus | Rating | Free Demo | Official website |

|---|---|---|---|---|---|---|

|

98% Payout | 10$ Min. Deposit | 70% Bonus | 5/5 Rating | Demo available | Visit Broker |

|

95% Payout | 20$ Min. Deposit | Up to 200% Bonus | 4.5/5 Rating | Demo available | Visit Broker |

|

95% Payout | 10$ Min. Deposit | No bonus | 4.5/5 Rating | Demo available | Visit Broker |

|

92% Payout | 50$ Min. Deposit | 50% Bonus | 4.4/5 Rating | Demo available | Visit Broker |

Digital Options Explained

The price of Stock A will be less than $500 at time expiry” is an example of a digital option, which allows investors to wager on whether the future value of the underlying asset will be greater or lower than a specific strike price.

Because of the binary nature of the outcome, the trader will either make a gain or lose money according to a predefined amount.

Options are a type of derivative that enable investors to speculate on price fluctuations without actually having to own the underlying asset. Investors may speculate on price changes without having to own the underlying asset by using options.

As a result of this, they are frequently utilized by individuals who have a limited amount of knowledge in the financial markets.

How does it work?

Traders of digital options manually select an expiration price for the option, which may be higher or lower than the current market price depending on the trader’s outlook.

The following step is for the broker to assign a likelihood to the asset reaching the strike price by the expiry time, ranging from 0 (the least probable) to 100 (the most likely), and then price the digital option in accordance with that probability (most likely).

When developing a pricing algorithm for digital options, brokers will take into account both the underlying asset’s volatility and the amount of time left until the option expires. As a direct consequence of this, the phrase “digital 100” is now commonly used to refer to this phenomena.

Gain or loss for a trader is calculated by multiplying the point spread by the disparity between the actual closing price and the forecasted closing price. This difference is known as the point spread. Consider the following example:

An investor takes a loss or gain of one dollar for every point if the price of a securities goes up or down.

In the scenario if the price is $60 when the option expires, the profit would be $100 minus $60, which would be $40.

If the price has not reached $60 by the time the option expires, the trader will suffer a loss equal to $60 from the option. The following formula is used to compute this loss: (60 – 0) x $1 = In order to turn a profit trading digital options, the trader needs to pick a greater number of winning options than losing options owing to the inherent imbalance between the two. (60 – 0) x $1 = In order to turn a profit trading digital options, the trader needs to select a greater.

Numerous options available digitally

Types Of Digital Options

ladder options: Investors are able to lock in a profit at specific ‘rungs’ along the way to the strike price through the use of ladder options. This is possible regardless of where the price of the underlying asset finally settles. This helps minimize the risk associated with options trading, which is important if you foresee a price movement but are unable to forecast which way it will go.

A trader who wagers that the price of an asset will either be higher than or lower than a certain level (the strike price) before the option expires.

One-Touch Options The holder of a One-Touch Option receives a payout if the price of the underlying asset hits the striking price before the option’s expiration. This occurs in the case of a One-Touch Option.

When trading target options, the investor is eligible for a dividend if the closing price of the underlying asset falls between the two strike prices at the conclusion of the trading day. Alternative names for this feature include dual digital options. When an investor has a firm feel of an asset’s volatility, he or she may pick the Hi/Lo trading style, in which he or she estimates the range for the market’s daily high or low.

Tunnel options are comparable to target options in that the trader picks a strike price (either high or low), but the reward is reliant on the asset not hitting either strike price during the option’s expiration period. Tunnel digital options, which are also referred to as double-no-touch options, are an excellent investment to make if you believe that the market will be pretty steady in the not too distant future.

Digital Options vs Binary Options

Binary options and digital options can be distinguished from one another in a number of significant ways.

Time frames: the contractual time frame possibilities for binary options and digital options are a little bit different from one another. Because the expiry dates of digital options are often much shorter than those of traditional options, scalpers may find them to be more appealing. Nevertheless, the precise timing could be different depending on the broker, the platform, and the item that is being traded.

When engaging in trading digital options, there is always the risk of experiencing further financial losses. As the price moves further away from the strike price, the loss becomes a greater percentage of the original investment. When using binary options, on the other hand, the worst thing that may happen to a trader is that they lose their initial investment.

As is the case with the risks, the potential rewards from trading digital options increase in direct proportion to the amount by which the underlying price deviates from the “strike price.” Traders employing binary options have no other conceivable outcomes but a predetermined payoff.

Traders have a greater degree of control over their transactions as a result of the fact that the strike prices of digital options are fully customisable and may be adjusted to whatever price the trader so desires. When engaging in binary options trading, the only thing you are required to do by definition is anticipate whether the value of an underlying asset will rise or decrease.

Binary options and digital options have significant parallels. Users will execute a purchase if they believe the market will increase to a level that is higher than the strike price, and they will execute a sale if they believe the asset will decrease to a level that is lower than the strike price.

Both binary and digital options only have two conceivable outcomes: they can either be correct or incorrect.

Binary options and digital options both have a time limit beyond which your position will be closed out automatically. This time limit varies depending on the kind of option. One significant benefit of using digital options is that traders have the flexibility to exit their positions prior to the option’s expiration.

When dealing in derivatives, investors and traders do not physically possess the underlying asset. Choosing the appropriate broker might make trading significantly more convenient and less expensive for you. In addition, it is possible that you will not be required to pay any taxes at all, depending on the location in which you now reside.

When trading binary options, the trader is required to make a prediction on whether the price of the underlying asset will have increased or decreased in comparison to its current value before the option’s expiration period.

As opposed to gambling on the path and proximity to a strike price, as is the case with digital options, the current price serves as the striking price.

The closer the projection gets to the strike price, the lower the potential profit that may be made from either call or put options.

In favor Trading digital options can provide various benefits, including the following:

In the case of a good forecast, returns may be large even if the time horizon is extremely small.

Utilizing hedging strategies is one way to lessen the amount of risk you are exposed to.

Before making any investments, the trader has a crystal clear knowledge of the potential gains or losses that might occur.

Cons of digital options

As is the case with all forms of trade, there are still some potential drawbacks:

Because the retail trading of digital options is illegal in many countries, it can be difficult to find a broker who is both legal and permitted to conduct business in this market.

If the business transaction does not go through, you will be out the total amount of your investment.

Regulation As a result of the popular misconception that digital alternatives are indistinguishable from gambling, a number of nations’ governments have enacted rigorous rules around these options.

Ordinary investors are not permitted to participate in binary options trading at all in the United Kingdom and Australia due to strict regulatory measures.

The only permitted venues for trading digital options in the United States are the Cantor Exchange, the Chicago Mercantile Exchange, and the North American Derivatives Exchange (Nadex).

The European Securities and Markets Authority (ESMA) removed its ban on retail traders in the European Union engaging in binary options trading on July 1, 2019.

The Cyprus Securities and Exchange Commission is considered a leader in the field of trading digital options due to the severe regulations that it has imposed on businesses dealing in binary options.

How to start trading digital options

In light of everything we’ve covered on how they function, let’s have a look at the initial steps:

- Find Yourself a Broker: For traders in digital options, a broker acts as an intermediary between you and the various marketplaces. Find out whether they provide the services that you require, such as a signals service, a mobile app, or a trial account, so that you may practice trading with virtual money before committing your real money to the venture. One broker, IQ Option, requires a minimum deposit of $10 for new traders to get started trading with them. Other brokers may also need minimum deposits in order to register an account.

- Pick an Asset to Analyze Gold and currency combos are only two examples of the numerous possible pairings that may be made with digital options. Both the liquidity of the asset and its volatility have an impact on the potential returns.

- The settings you choose will be influenced by both your trading strategy and your analysis. To safeguard yourself against a decline in the price of your digital options, one strategy you may employ is known as a “call spread,” in which you purchase calls at a lower strike price and sell calls at a higher strike price. The delta, which is the ratio between the price of the underlying asset and the change in the price of the option, may also be computed as a measure of trading risk. This ratio can be thought of as the price of the option divided by the price change.

- After a trade has been made, all that can be done is to “sit tight” and wait for the asset’s price to reach the strike price or until the option expires. On the other hand, if the binary outcome doesn’t go your way, you may be able to bail out of a trade before it’s even finished if you’re dealing with specific digital options brokers.

Conclusion about Digital Options

Investors have the ability to make binary price predictions on a wide variety of underlying assets when using digital options. However, because to the significant risk that is associated with each transaction, even experienced traders in digital options will typically adopt hedging tactics in order to limit the extent of their losses.

Start trading digital options right now at one of the sites we’ve advised using from the list we provided.

FAQs

What Are Digital Options?

digital options are a sort of derivative asset, traders may speculate on whether or not the asset’s future price will be greater than the strike price and then make trades based on their predictions.

Are digital options American or European?

American-style digital options result in a payout whenever the asset price hits the strike price, while European-style digital options result in a dividend only on the striking date.

What are the differece between Binary Options and Digital Options?

The striking price of a binary option is always the current price. This is because the sole potential outcome of a binary option is either an increase or a decrease from the current price. The striking price of digital options is controlled by the trader, making them susceptible to both price movement and trend.

Are digital options Halal?

If the trader has done their research, then option trading is regarded as being compliant with Islamic law. However, if they incorporate any type of gambling, they are banned by Islam. If you need direction, seek a spiritual figurehead in your region.

What are the advantages of trading digital options?

The use of digital options is a straightforward method for making a wager on the potential value of an asset in the future, which, if the prediction is accurate, has the potential to result in large gains in a relatively short amount of time.

Is there a difference between Forex and digital options?

Foreign exchange (Forex) investors have the option of opening either a long or short position on a currency pair. These two trades have quite different potential results based on the movement of the asset price. When it comes to dealing with digital possibilities, you will either be successful or unsuccessful.