Binary options hedging strategy

Binary options can be a great way to speculate on markets. This particular form of trading allows investors to take a position on an asset’s future price movement and use them as a hedge.

The binary options market is a financial market where investors trade on whether a specified asset will be above or below a specific price at a particular time. These options are also known as “digital options” because the trade doesn’t require any physical movement of assets. The binary option uses two possible outcomes, which are either “in the money” or “out of money.”

Binary options can be used by traders to hedge their investments, as well as speculate on certain outcomes.

Traders benefit from binary options because the payout decisions are binary in nature. It makes it easier to follow, and more like gambling on the outcome.

Binary options payout either all or nothing, depending on what the outcome is. With binary options, you can expect your winnings to be more in line with the amount of risk you take because the payout is either fixed or a percentage of how much you bet. The idea that binary options pay out all or nothing makes it easier to understand, but also more akin to gambling on the outcome.

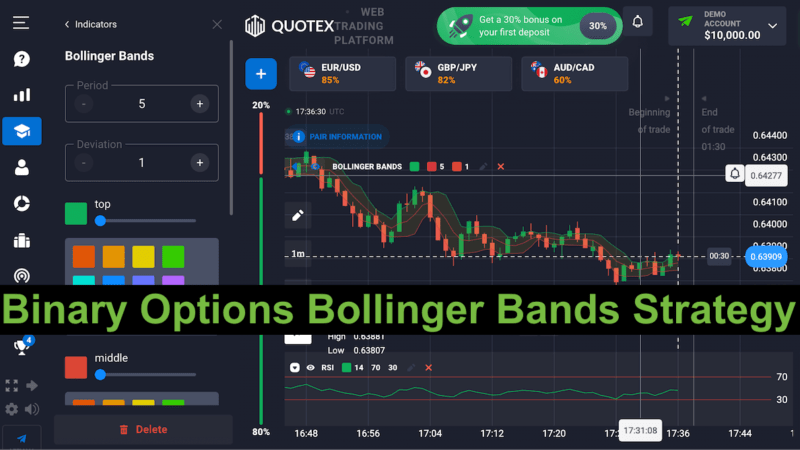

here is a video explaining the concept of hedging and how to apply this strategy to trade binary options

Hedging Strategies for binary option trading

In fact, some sharp traders use binary options on their FX positions to hedge profits and extend profitability in case of small pullbacks.

Binary options are often used to mitigate the effects of currency fluctuations and write risk off in a certain amount of time. A hedge between two positions is also an option with binary options.

Hedging in this instance means using binary options in such a way to come up with a way to lose only slightly while being open to higher gains

A hedge is a strategy used to reduce risk and maintain a certain level of profit. In the financial world, hedging is the act of taking opposing positions in different markets to protect against adverse price movements. Binary options come with a strike price, expiration period and a contract. It is possible for the expiration period to be as short as a few hours. A binary call option will pay the amount if the price exceeds the strike price at expiration. A put option would not.

People buy a binary option based on the price of the asset at expiration time. If the asset is above the strike price, it pays out as a profit. If not, it fails and loses everything put in. Binary options have been around for over a decade, and they are still increasing in popularity due to their ease of use and ability to generate high returns

A binary call option pays $100 if the stock has a certain value at expiration and is worthless if it doesn’t. A binary put option, in contrast, only pays out if the stock falls below a certain price at expiration.

Hedging a binary option is the process of buying a put and call on the same stock, with strike prices that are both time in the money.

It means that not only will you break even if the option expires at the lower strike price, however, in order to make any money, prices must fall below the higher strike price.

This is a scenario on how an investment into binary options work. It requires considering different variables, a minimum price, and the size of which can be determined by you. Multiplying this all together for an estimate of costs will give you the best idea about whether or not it’s worth your time

It’s a trading strategy called hedging, it protects you in the case that something goes wrong.

The strategy of this option is contingent on you losing the investment in one of your options, but if you do so, it will still pay out. This can help cushion the loss. This means you will still take a loss. However, the stakes are much lower than if you had invested in the market more aggressively due to the reduced payback of this particular option.

This is an option for traders that want to make some extra income in a largely unexplored route. You buy two options with opposite prices, so at least one of them will make some money. With the money you would gain from each bet, you can win at a greater rate than with just one option. If you should lose money with multiple options, it won’t be as difficult to collect all that has been lost compared to losing your cash on just one option. It’s a useful tool to add to your trading arsenal.

Example of a Binary option Hedging

A real-life example of a binary option hedge. A forex binary option is a type of very high-risk trading strategy that typically offers two possible outcomes, neither of which is certain. In this instance, the Euro has been rising & is predicted to keep on rallying at a determined breakout point. At the current level, we would expect the Euro to keep on rising. A put option is an option that allows you to sell shares of a stock at a preset price. This price is called the strike price and will be set prior to purchase. If the price crashes and falls, you may be able to support your position by place a put option at another point.

You have placed a call option with an exercise price of $500, trading at 5.1 (Option value- the difference between the premium payment and the strike price) You have also placed a put option with an exercise price of $500, trading at 5.3 (Option value- the difference between the premium payment and the strike price)

The following outcomes could happen:

- Based on the current price of EUR at 5.1, this call option is in-the-money. This means it increases in value by $500 when you exercise it. If your investment was placed on the stock, the value went up such that your put option would now be in-the-money and you would receive a $850 profit. This trade would end up being a net gain.

- The Euro price could be between 5.1 and 5.3, so both your put option and call option are in-the-money at the same time. If you divide the cost of the trade into its return, this trade will give you a net profit of $700.

- You opened a call option this morning with EURUSD trading at 5.1 and could get back the initial $75 investment if the price ever fell below that level. If the price of your stock is in-the-money at the time of the trade then you received $850 as a profit for your initial investment. Total investment= $1000. Profit= – $75. (-500 + 75 + -500 + 850) This trade would lead to a net loss. However, in other cases where these conditions are met, you end up saving much more than you could have by just accepting this offer.

- You would make $850 in return of your initial investment if the Euro price goes up to 5.3 and the call option expires in-the-money. After putting an option order with a higher strike, this would occur. In this example, your put option is out-of-the-money and you get $75 on your initial investment. Total investment- $1000. Profit= -$75. (-500 + 850 + -500 + 75) If this trade is closed, you will get a a net loss, but you will only lose less than what you stand to lose in other scenarios.

- Your put option is at-the-money because the euro price is at 5.3. You would receive $500 in return of your initial investment. You put option is in the money and you would receive $850 of your initial investment. Total investment= $1000. Profit= $350. (-500 + 850 + -500 + 500) A trade would result in a net gain.

There are many options for hedging, which allow you to make sure you get a bigger profit from your bets instead of losing everything. If you are in a position where you can lose money, there is a much greater chance that you can make a greater profit than you would have lost in any other situation.