Binary options RSI crossover entry strategy

The relative strength index (RSI) is a versatile indicator that may be used to signal entry points into an ongoing trend. The signals are derived by applying a moving average to the relative strength index (RSI). Using free charting tools provided by most binary options brokers, you can use this indicator easily. The Relative Strength Index (RSI) may be added to a chart by selecting “Add Indicator” from the context menu that appears when you mouse over “RSI.” When the drop-down menu displays of your Indicators on your binary option trading platform, to use it, yous need to select “RSI or Relative Strength Index.”

Contents

RSI Adjustments

The RSI’s default value is 14, although that’s more typical of daily charts than shorter time frames, so you may need to play about with it to find what works best for your trading style. A relative strength index (RSI) calculated over twenty-one time periods and a moving average of the RSI generated over ten time periods were used in the following examples, which were based on an hourly chart. In the wake of a clear trend’s establishment, this method appeared to provide reliable trade signals.

General Strategies for Responding to Trends in the Relative Strength Index

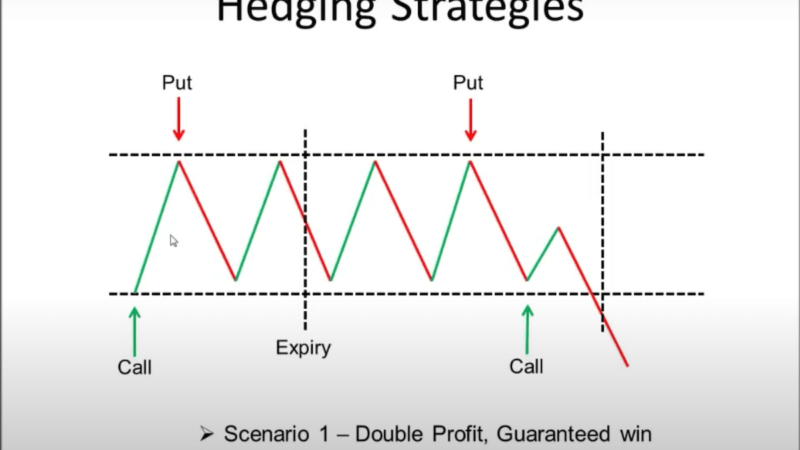

There needs to be a pattern before the strategy can be put into action. The presence of an upswing will be shown by an increase in the average distance between swing highs and swing lows. Identifying a downward price trend requires looking for a series of declining swing lows and rising swing highs.

Only trades that follow the current trend will be processed. Invest in long positions only when the market is exhibiting a rising trend. It’s best to go short just when prices are falling (puts).

When the RSI rises over 60, it signals a reversal in a bearish trend. To short the company, wait for the relative strength index (RSI) to fall below its moving average, which can happen at any RSI reading so long as the RSI is currently or was recently over 60.

If the RSI falls below 40 when the market is in an uptrend, this might signal a reversal in the trend. When the RSI re-crosses above its moving average, it signals a buying opportunity. This can take place at any RSI reading, as long as it is now (or has been during the last few readings) below 40.

Wait until the price has moved at least two or three bars in the time frame you’re trading on before selecting an exit plan. This will give the market more time to move in your favor and bring the price down.

As can be seen in Figure 1, this RSI entry strategy may be used when there is an upward trend.

A Buying Signal Based on the Relative Strength Index (Figure 1)

rsi-1

Now that the trend has turned up, all we need are indications to buy. When the RSI drops below 40 (the yellow horizontal line), it’s time to pull back. Following a drop in the RSI below 40, we will aim to buy when the RSI (red line) rises above the MA (white line).

You can see this RSI entry strategy in action in Figure 2 when it is used to trade against a falling market.

Figure 2: RSI Sell Signals

rsi-2

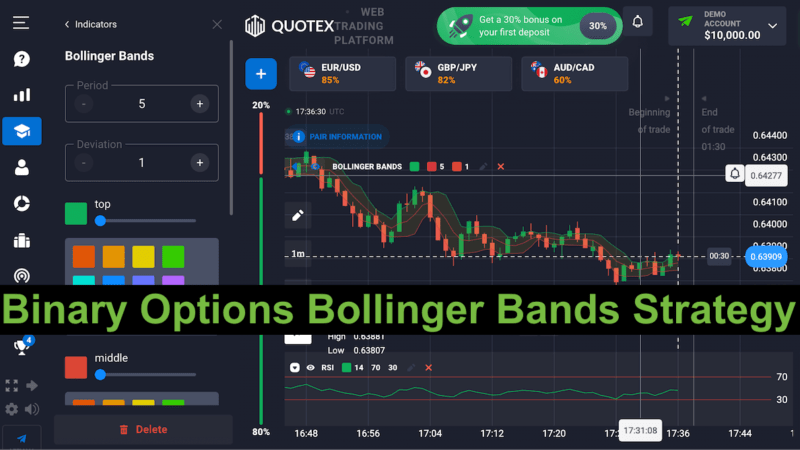

Only short (put) transactions should be considered at this time due to the EUR/USD pair’s current negative trend. Even if the majority of the price activity on the chart consists of sideways motion from left to center to right, the broader trend is still pointing downwards. Given that the negative trend persists, we are in a position to maintain our short positions at this time.

If the RSI increases above 60, it is time to withdraw. As soon as the RSI (red line) drops below its moving average (yellow line), we will take a short position once the RSI (red line) has rebounded over 60 (yellow line) (white line).

In an upswing, level 40 acts as a trade filter, and in downswing, level 60 does the same. By waiting for the relative strength index (RSI) to move above certain levels, we can enter the trade during a decline in the direction of a larger trend. If the Relative Strength Index (RSI) crosses above or below its 20-day moving average, it indicates that the prevailing trend is likely to persist.

Conclusion

This is only one of several entryways available. Set your stop loss order below the most recent low for long positions and above the most recent high for short positions when trading on conventional markets. An expansion technique based on the Fibonacci sequence might be used to determine the desired price points. Researching the typical time it takes for the price to go into the money is an important first step in determining the optimal expiry time when trading binary options.

Each market or currency pair may benefit from a slightly varied RSI value. Once a pattern is spotted, the parameters should be tweaked incrementally until those that work reliably with the market, time frame, and pair in question are located.